When Does Chapter 13 Get Removed From Credit Report

Table of Contents

- How Long Volition Bankruptcy Appear On Your Credit Study?

- Can Y'all Remove A Defalcation Early From Your Credit Written report?

- When Is It Possible To Remove A Bankruptcy From Your Credit Report?

- How A Defalcation Filing Affects Your Credit Score

- Will Your Credit Score Stay Poor Until Your Bankruptcy Is Removed From Your Credit Report?

- Can You All the same Get A Loan Even With A Bankruptcy on Your Credit Report?

- Credit Cards

- Car Loan

- Mortgage

- How to Build Your Credit After Filing for Bankruptcy?

- 1. Don't open new accounts all at one time

- ii. Don't max out your credit limit

- 3. Maintain On-time Payments

- Remember Before You File

This post may contain affiliate links. Which means we may earn a commission if y'all determine to make a purchase through our links. Please read our disclosure for more info.

If you lot're drowning in debt and you don't have any way out, bankruptcy could be the only pick that could save yous and requite your finances a fresh start. It'due south an opportunity to wipe the slate clean and start over with the hopes that you'll make smarter financial decisions this time effectually.

However, many people realize also late that filing for bankruptcy does not necessarily mean yous'll have a totally clean and blank slate. The bankruptcy will continue to appear in your credit written report for several years, which will, in turn, touch on your fiscal transactions.

Because of this, you might exist wondering whether it is possible to remove bankruptcy from your credit report before the usual time frame. This article volition answer these common questions related to getting a bankruptcy off your credit report.

How Long Will Defalcation Appear On Your Credit Written report?

You probably accept heard that the length of time your bankruptcy volition stay on your credit report volition depend on the type of bankruptcy you filed for. At that place are two types of bankruptcy filings in the United states of america.

The starting time one is Chapter 7 and the other one is Chapter xiii. If you filed a Chapter 7 bankruptcy, what typically happens is that some of your belongings or possessions can be sold off or liquidated to allow you to pay for your debts, plus, some of your debts may too be discharged. When a debt is discharged, this means you don't take to pay for it whatsoever longer.

After completing this defalcation procedure and your debts are discharged, this tape will stay on your credit report for upwards to 10 years from the time of filing. The length of time it stays on a credit written report is so long that many people wonder if yous can remove a Chapter 7 from a credit written report before x years.

On the other hand, a Chapter xiii defalcation is a process wherein yous create a payment programme to pay all or some of your debts in three to 5 years. Once courts corroborate the payment program, y'all will have to pay a fixed amount either monthly or biweekly on a regular basis. If y'all file a Chapter xiii bankruptcy, it volition remain on your credit report for upward to 7 years from the time you filed.

Can You Remove A Bankruptcy Early From Your Credit Study?

If you do a quick search over the internet, several articles land that it is possible to remove a bankruptcy from your credit study early. Because of this, people who have experienced a bankruptcy start having hopes that it is possible. However, many articles do not analyze that getting a defalcation off your credit report is but possible in very specific circumstances.

The reality is if y'all have filed from a bankruptcy and your debt was discharged, yous cannot go it off early from your credit report but because you want it to be gone. Even if your credit score is very high, you frequently cannot exercise anything only to wait it out.

The elementary answer to do this question is NO. If your defalcation was legitimate and you received a bankruptcy discharge, meaning you don't have to pay your debts, then that means that it volition have to take 7 to 10 years for your bankruptcy records to fall off from your credit written report. Fifty-fifty if you have a dismissed bankruptcy, you cannot easily remove this from your credit written report early.

When Is It Possible To Remove A Bankruptcy From Your Credit Study?

What about all of those people saying that they were able to remove a bankruptcy from their credit report early? Are they lying? These might be some of the questions floating around your listen correct now. If they could do it, how come I can't remove bankruptcy from my credit report early?

As mentioned in the earlier department, y'all tin can only remove a bankruptcy off your credit report in certain circumstances. When is this possible?

The only manner yous can get a bankruptcy off your credit report is if there are inaccuracies or errors on your credit report. When you were filing for bankruptcy or even after your debt was already discharged, it is not uncommon for y'all to feel overwhelmed and unfocused, Because of this, y'all may non have noticed slight mistakes in your credit written report. These mistakes could exist spelling mistakes, incorrect addresses and phone numbers, spelling of names, and even discharged debt that still prove a balance.

If these errors exist, you can then movement forward and dispute these wrong entries. Here is the step by step process.

1. Carefully review your credit report and bank check for whatever mistakes, however small they are.

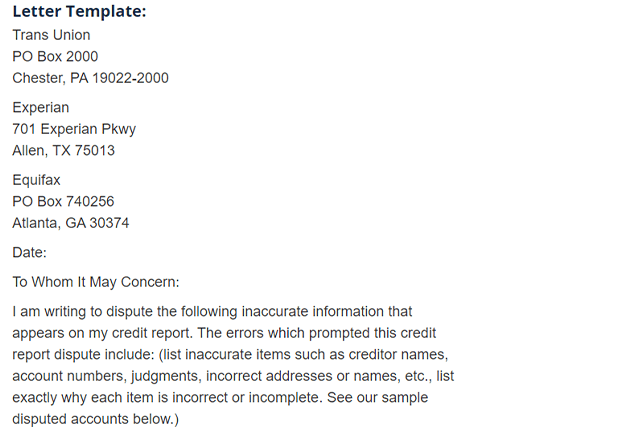

2. When yous find any of these inaccuracies, y'all tin can dispute the defalcation entry by sending a credit dispute letter to the credit bureau. You can check this sample letter of the alphabet from a legal firm on how to go about this step.

View the full sample letter at How to remove bankruptcy from credit study – sample letter of the alphabet

iii. If the credit bureau is unable to verify the information, there is a chance that they will just remove information technology from your credit study. That is, of class, what y'all want to happen.

4. Still, if the credit bureau is able to verify it, you may have to challenge them with who they verified the information. If they said they verified the data with the courts, you may have to send a letter to the court verifying if the credit bureau indeed did the verification. If the courts did, and then that'due south the end of the road for yous. On the other hand, if the courts say that no verification took place, you can ask for a written proof and become back to the credit bureau to demand that they remove the bankruptcy.

The dispute process is non easy. It is a long and tedious process that's why many people seek out credit repair companies to practice this process for them. People who have used credit repair companies shared in online forums that these companies were able to remove bankruptcy entries in their credit report, while some say that these companies are zip just a scam every bit they were not very helpful.

Some other current challenge with this dispute process is that everything now is electronic, so information technology is not equally difficult to verify public records nowadays as anyone can verify data in but a few minutes.

While the process above may have worked in the past when a lot of people were still going by paper files and documents, mod engineering and systems used by the credit bureaus make information technology hard to challenge or dispute entries in your credit report.

How A Defalcation Filing Affects Your Credit Score

When you file for defalcation, your credit score will drop. The range of the drop is usually 130 to 240 points. Typically, people who have a higher credit score of over 700 points lose more than points. If yous already have a poor credit score, the deduction of these points may not really impact you that much.

When you have a defalcation on your credit score, it can exist difficult to get approval for new credit and get the best deals people with excellent credit scores enjoy. For instance, if you are planning to get a cell phone plan with bad credit, you will not be eligible to go the best deals available that require no eolith or no upfront fees. If you lot take bad credit due to a defalcation, you may have to settle for a no credit check cell phone plan where you have to buy the device in full and prepay your usage.

Will Your Credit Score Stay Poor Until Your Bankruptcy Is Removed From Your Credit Report?

One mutual misconception is that your score will remain poor during the duration the bankruptcy is on your credit study. This is not truthful at all. In fact, you lot can get-go rebuilding your credit later on your debt is discharged. According to bankruptcy experts, there is fifty-fifty a adventure that your score will become above 700 later on 4 to five years.

Can You lot Still Become A Loan Even With A Bankruptcy on Your Credit Report?

Many people think that just because they filed for defalcation, and then this means that they volition not be able to get a loan or a new line of credit. The truth is, there are many different companies and lenders that specialize in lending to people who just filed for bankruptcy or with bad credit.

Of course, you will find that the interest rates and the fees are high compared to when yous nonetheless had a stellar credit score. That's why it's important to be cautious and to non exist blinded by the unbelievable offers immediately after your bankruptcy discharge. Make sure that you read the fine print and clarify all the details before going for a loan or a credit bill of fare. You don't want to end up in a more dreadful situation than you were in pre-bankruptcy.

And so, what types of loans or credit are you lot still eligible for even subsequently filing for bankruptcy? We listed downward the credit options for you

Credit Cards

After a bankruptcy discharge, regular credit carte companies may not consider you every bit a good gamble, but you lot can still avail of secured credit cards that normally practise not require any credit checks. After a Affiliate 7 defalcation, you lot may have to wait until after the completion of your bankruptcy case before applying to make sure you'll become approval. This will take about 3 (3) months. If you filed for a Chapter 13 bankruptcy, it may take 3 to 5 years before you tin can utilise.

What is a secured credit card? Unlike regular credit cards, y'all will need to pay a deposit to go a secured credit card. The deposit volition usually exist equal to your credit limit. So, if your deposit is $1,000, then that is also the amount yous can spend on the menu.

You may be thinking:

What's the use of getting a credit card if I have to deposit the same amount in cash? It's because this is ane mode to rebuild your credit score. Dissimilar a prepaid card, a secured credit card reports your payments to credit bureaus.

When applying for a secured credit bill of fare, be wary of the loftier interest rates. Some credit card companies will attract you by giving offers similar no annual fee without you realizing that the interest is double or triple than the other credit cards.

Another option is to detect store credit cards that approve applications from people with bad credit. These store credit cards typically take low application requirements compared to banking concern credit cards.

Car Loan

To get a car loan, you have to complete your bankruptcy discharge showtime. If your example is nonetheless ongoing, information technology will be difficult to get an approval. You have to testify proof of your defalcation discharge. Afterward that, you can detect automobile loan lenders who are willing to give you a car loan even later bankruptcy. If you can beget to pay a down payment, this will increase your hazard of getting approved.

Withal, it is appropriate to expect for a few months before getting a car loan. Try to commencement rebuilding your credit offset past using a secured credit card. This will open better deals for you compared to applying for a car loan immediately afterward a bankruptcy discharge. Information technology is too wise to go for 2nd-hand cars or other more than affordable options when getting a car loan after bankruptcy.

Mortgage

If you are planning to buy a business firm, y'all don't need to await for 7 to x years before y'all can avail of a home loan. The usual waiting time to get an FHA loan or a VA loan is 12 months to 2 years from the discharge date, depending on your circumstances and what type of bankruptcy y'all filed.

For Fannie Mae, Freddie Mac, or Ginnie Mae, yous may have to wait 2 years to four years before yous can apply. Over again, you have to kickoff rebuilding your credit score to brand sure you become a improve run a risk of approving when applying for a mortgage.

How to Build Your Credit Later on Filing for Bankruptcy?

If you are one of those people who desire to swear off credit altogether, this is really a bad idea. You want to rebuild your credit score afterward bankruptcy fifty-fifty if you don't have whatsoever immediate plans on making big purchases. This is because when you have a good credit score, it gives you lot access to better deals and savings. You don't have to pay deposits or high-interest rates when getting necessary services like utilities and cell phone plans.

And so, how can you rebuild credit without going nether debt again? Hither are some applied tips.

i. Don't open new accounts all at once

Afterward a bankruptcy discharge, it might surprise you that you'll go a lot of credit card offers. Many of these offers are for secured credit cards with sky-high involvement rates. Companies now consider you a improve take a chance because you lot don't have a lot of debts anymore. However, opening multiple new accounts at one time could make it difficult for you to maintain regular payments and this could damage rather than help your credit score.

two. Don't max out your credit limit

Only utilize upward to 30% of your credit limit. Maxing out your limit every month will get in harder for you to keep up your payments.

iii. Maintain On-time Payments

Religiously pay your bills on-time, every single time. A late payment can hurt your credit score further. A good idea is to use fiscal management apps like Mint or Personal Capital letter that have bill reminder features so you will not miss payments again.

Think Before You File

If you lot are just thinking of filing for defalcation and you are moving forwards because you think that there are ways to bypass the vii to 10-year time frame, so call back once more. There are no guarantees you lot can remove a bankruptcy early from your credit report, especially if it is a recent filing.

When Does Chapter 13 Get Removed From Credit Report,

Source: https://houseofdebt.org/remove-bankruptcy-from-credit-report-early/

Posted by: broseliffe1937.blogspot.com

0 Response to "When Does Chapter 13 Get Removed From Credit Report"

Post a Comment